In a world where trading simulators have become indispensable tools for aspiring investors and seasoned traders alike, the allure of a risk-free environment often overshadows the potential pitfalls. These digital platforms offer a tantalizing glimpse into the fast-paced realm of financial markets—where emotions run high, strategies are tested, and fortunes can change in the blink of an eye.

But beneath the surface of this seemingly ideal practice ground lies a complex web of challenges and misconceptions. While the ability to experiment without financial repercussions is undeniably appealing, trading simulators can inadvertently instill habits that might hinder performance in the real world.

They may create false confidence, leading to unrealistic expectations when faced with actual market volatility. As we delve deeper into this topic, we will explore the hidden downsides of trading simulators and what every trader should consider before diving into their virtual trading journeys.

The Advantages of Trading Simulators

Trading simulators offer numerous advantages that can enhance the skills and confidence of aspiring traders without the risks accompanying real market participation. For one, they provide a safe, controlled environment where individuals can experiment with various strategies—adjusting parameters, testing risk tolerance, and observing market reactions—without the fear of losing hard-earned money.

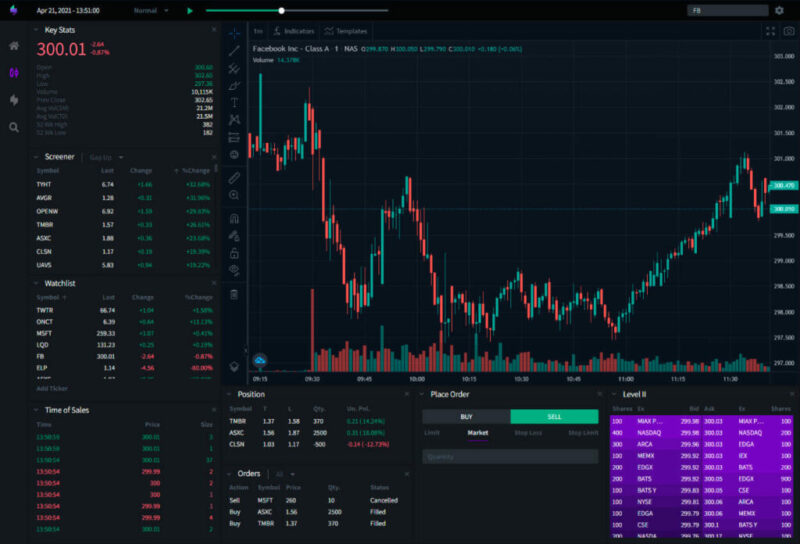

This virtual playground allows for rapid learning through trial and error, fostering an intuitive grasp of market dynamics. Moreover, traders can access historical data and run simulations that replicate past market conditions using tools like replay chart free software. This feature enables them to refine their techniques under a multitude of scenarios, enhancing their ability to handle various market situations.

This blend of practice and analysis not only sharpens trading acumen but also builds emotional resilience, preparing individuals for the psychological highs and lows of actual trading. Ultimately, simulators and replay chart tools serve as a bridge between theory and practice, equipping traders with the tools they need to navigate the complexities of the financial landscape with greater ease and expertise.

Potential Downsides of Trading Simulators

While trading simulators can offer valuable practice and insights, they are not without their drawbacks. One significant downside is the psychological dissonance that can arise when traders transition from a simulated environment to real markets.

In a simulator, the consequences of trading decisions are often muted—profits and losses feel less tangible, leading to overconfidence in one’s strategies. Furthermore, these platforms typically lack the unpredictable emotional elements of live trading situations, which can skew a trader’s understanding of risk management.

Additionally, some simulators might not fully replicate transaction costs or slippage, creating a distorted perception of profitability. This can foster unrealistic expectations and poor decision-making when actual stakes are on the line.

Understanding these limitations is crucial for anyone looking to turn simulated strategies into successful real-world trading.

Best Practices for Using Trading Simulators

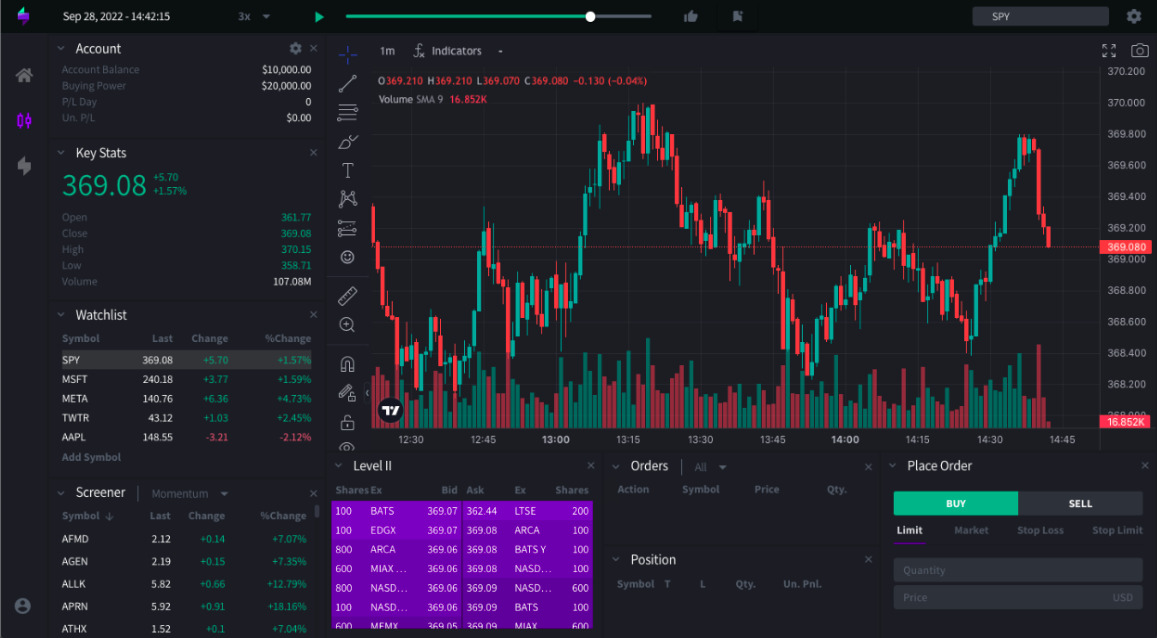

When utilizing trading simulators, it’s essential to approach your practice with a strategic mindset. First and foremost, develop a diverse trading strategy before you start; this allows you to experiment with different tactics without the risk of real capital.

Invest time in understanding the platform’s features, such as charting tools and order types, to maximize your learning experience. Additionally, treat your simulated trading like a real-world scenario—set firm goals, maintain discipline, and review your trades critically.

Experimentation is key, but it should be paired with thorough analysis to understand what works and what doesn’t. Lastly, don’t forget to integrate emotional discipline into your practice; even though the stakes are lower, the psychological aspects of trading remain relevant.

By approaching your simulator use with these best practices, you can better prepare yourself for the complexities of real market conditions.

Conclusion

In conclusion, while trading simulators offer invaluable benefits for both novice and experienced traders, it is vital to recognize their limitations. Relying solely on these platforms can lead to overconfidence and a disconnect from the realities of live trading, where emotions and market conditions play a significant role.

Additionally, the lack of real risk can create a false sense of security, hindering the development of critical decision-making skills under pressure. However, tools like replay chart free software can complement simulation training by providing a realistic environment to practice and refine strategies based on historical data.

Ultimately, a balanced approach that incorporates both simulated and real trading experiences is essential for fostering a well-rounded skill set in the dynamic world of trading.