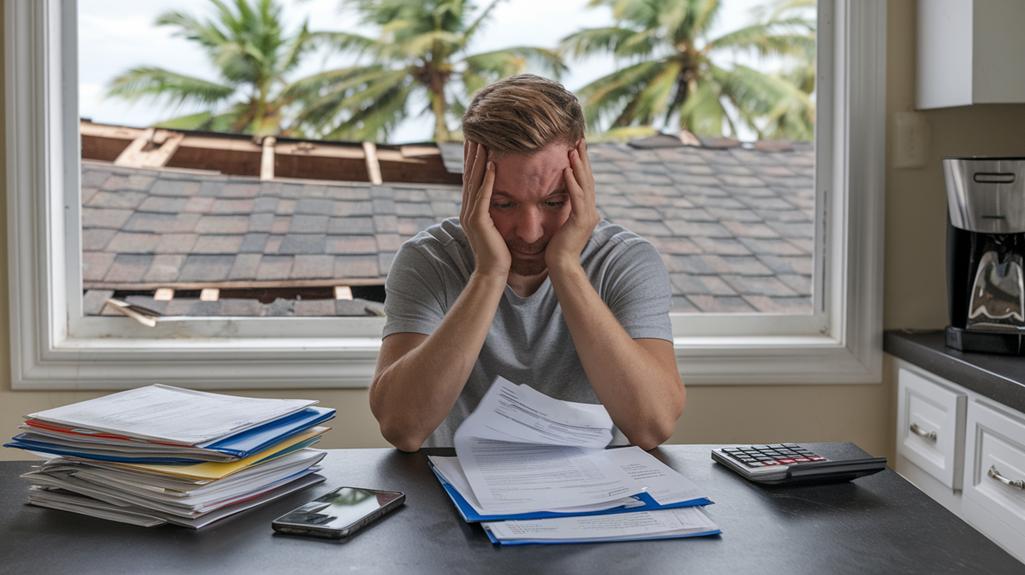

Navigating the labyrinth of insurance claims can be a daunting task, especially when your claim is unexpectedly declined. It’s a frustrating experience that leaves many feeling lost and overwhelmed.

You may wonder, “What’s next?” The harsh reality is that a denied claim can not only disrupt your financial stability but also cast doubt on your understanding of your rights. Whether it’s due to confusing policy language, unexpected stipulations, or a simple clerical error, a denied insurance claim doesn’t have to be the end of the road.

Armed with the right knowledge and support, you can challenge that decision and reclaim your peace of mind. In this article, we will explore how expert assistance can be your most valuable ally in turning that denial into a successful resolution.

Common Reasons for Insurance Claim Denials: Are You Affected?

Insurance claim denials can be a frustrating experience, often leaving policyholders bewildered and unsure of how to proceed. Common reasons behind these rejections range from insufficient documentation to policy exclusions that may not have been clearly understood.

For instance, failing to provide adequate proof of loss or neglecting to notify the insurer within the stipulated time frame can trigger a denial. Additionally, discrepancies in the information provided, such as inconsistencies between the claim and the original policy terms, can raise red flags.

Some claims may even be denied due to a lack of coverage for certain circumstances, which often leads to confusion about what’s included in the policy. If you’ve found yourself facing a claim denial, it’s crucial to assess your situation closely—understanding these common pitfalls could illuminate why your claim was rejected and guide you toward effective remediation strategies.

Steps to Take Immediately After Your Claim is Denied

When your insurance claim has been denied, the immediate response can feel overwhelming, but taking prompt action is crucial. First, carefully review the denial letter; understand the reasons behind the decision.

Don’t hesitate to contact your insurance company for clarity—sometimes, miscommunication is to blame, and a simple phone call can shed light on the situation. Gather all relevant documentation, including policy details and any correspondence related to your claim, as these will be vital for your appeal.

Next, consider drafting a formal appeal letter, articulating your case clearly and concisely while referencing specific details from your policy that support your claim. Engaging with an expert—whether an attorney, insurance consultant, or claims advocate—can provide invaluable assistance; these professionals understand the nuances of insurance policies and can help strengthen your position.

Remember, acting swiftly and strategically can dramatically influence the outcome of your appeal.

Conclusion

In conclusion, facing a declined insurance claim can be a daunting and frustrating experience, particularly when it comes to complex situations like a rejected TPD claim. However, seeking expert support can make a significant difference in navigating the appeals process and advocating for your rights.

By enlisting the help of professionals who understand the intricacies of insurance policies and legal requirements, you can increase your chances of a favorable outcome. Don’t hesitate to reach out for assistance; with the right guidance, you can turn your setback into an opportunity for resolution and reclaim the protection you deserve.